After over two years battling Cigna in its typical out-of-network fraud and fee-forgiveness protocol claims, Humble Surgical Hospital, LLC emerged victorious in a court judgement in the Southern District of Texas.

Judge Hoyt blasts Cigna’s Abuse of Discretion

Judge Kenneth M. Hoyt blasted Cigna in a 54-page opinion ordering the physician-owned out-of-network hospital to be paid over $13 million plus attorney’s fees. In applying the 5th Circuit’s 2015 opinion in North Cypress Medical Center v. Cigna, the Court made clear that Cigna’s interpretation of its infamous fee-forgiveness protocol plan exclusions is not only “legally incorrect” as North Cypress suggested, but also a complete abuse of discretion. The judgement included

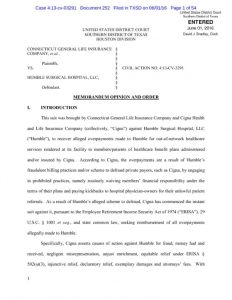

Judge Hoyt Opinion and Order

Humble Surgical not “Fee-Forgiving”

Out-of-network facilities across the country have been faced with allegations that they are fee-forgiving by Cigna and other insurance carriers just because they have been unable to collect the full cost-sharing co-pay / deductible on or before the time of service. Anyone in the industry would understand the absurdity of such a standard that exists nowhere else, but has been reaffirmed and made clear by this trial-level district court case, as the court says “[f]ee-forgiving occurs only when a healthcare provider fails to attempt to collect co-pays, co-insurance or deductibles.

Cigna’s Cost-Containment Fees

The court interestingly pointed out that Cigna’s methodology for claim processing in essence subverted the plan administrator’s role for its own “personal benefit.” Though the court only touched uponhow Cigna personally benefits from its “abuse of discretion,” it was at least a subtle rebuke to Cigna’s “cost-containment” fees that would purportedly award Cigna for paying nothing.

“paying nothing just smacks of a lack of genuine effort”

Cigna “Violated ERISA”

The judgement included $2.3 million in statutory penalties under ERISA. For those on the insurance side, do not feel bad, as there is little doubt that Cigna was unaware of the precarious application of its fee-forgiveness exclusion interpretation. In a 2008 red-flag waiving email from Cigna’s counsel to an internal appeals and medical director, Susan Morris, Esq. stated the she did not believe “paying nothing [to North Cypress Medical Center] is a viable option” and that “paying nothing just smacks of a lack of genuine effort to determine the proper charges and apply the correct plan benefits.” See Cigna’s Email from North Cypress.

Humble Surgical Opinion and Order Nuggets

The Humble Surgical decision is full of nuggets that have likely made Cigna’s counsel cringe in their consideration for an appeal. Here are some of the highlights of the opinion:

- …Cigna interfered with and frustrated the contractual relationship between the plan sponsors and the members/patients by imposing a methodology for claim processing that was not part of any plan.

- In essence, Cigna “hijacked” the plan administrator’s role and subverted it for its personal benefit.

- Indeed, Cigna’s unprecedented claims processing methodology and incessant related acts were extraordinary acts of bad faith.

- …Cigna abused its discretion by obstinately denying Humble’s claims for benefits in spite of the medical services provided by it…

- The Court is of the opinion that ERISA does not permit the interpretation embraced by Cigna.

- Hence, Cigna’s “exclusionary” language interpretation does not pass muster under the “average plan participant” test.

- Cigna’s interpretation of the “exclusionary” language as rejecting covered services, was improper and violative of the plans’ terms.

- For these reasons, the Court determines that Cigna improperly applied the exclusionary language contained in the plans and, in the process, abused its discretion, especially since Cigna admittedly has never used the exclusionary language to reject covered services before and was relentless in engaging in an arbitrary manner with regard to Humble and its claims.

- Cigna did not seriously consider the amounts of Humble’s claims even though the services were billed according to CPT Codes.

- The Court finds that Cigna’s reliance on a proportionate share analysis for processing and paying Humble’s claim was not only improper but amounts to a breach of its fiduciary duty to the members/patients and Humble, as an assignee of such benefits.

- Cigna’s method for processing Humble’s claims was simply disingenuous and arbitrary, as it was focused more on accomplishing a predetermined purpose–denying Humble’s claims.

- Thus, Cigna breached its fiduciary duty when it strayed from the terms of the plans and interpreted its ASO Agreements with plan sponsors as conferring authority upon it that was not specifically set forth in and/or was contrary to the various plans.

- Because Cigna failed to process Humble’s claims pursuant to the plans and ERISA, it also denied Humble a meaningful opportunity to appeal any claim denials and/or underpayments.

- Humble was entitled to a fair review of its claims, both at the claim processing stage and, likewise, at the appellate review stage.

- Therefore, the Court holds that Cigna’s claims processing procedure and appeals review process violated ERISA and concomitantly, its fiduciary duty of care and loyalty to the members/patients and the plan sponsors.

- Indeed, Cigna earned handsome returns as a result of its aberrant and arbitrary claims processing methodology. The evidence establishes that it was subject to a double heaping from the plan sponsors’ pockets—first, in receiving a fee for claim processing services–and second, in receiving fees based on “savings,” regardless of how garnered.

- In the process, however, Cigna forfeited its objectivity and violated its fiduciary duties of care and loyalty by making benefit determinations that did not consider UCR or conform to the plans’ terms in violation of ERISA.

- Further, the Court concludes that Cigna has acted in bad faith with regard to processing Humble’s claims by failing and refusing to provide pertinent plan documents and related information.

This was a very bad decision for Cigna and the attorney’s for Humble Surgical Hospital are likely waiting for the 30 days from the June 15, 2016 order to receive a notice of appeal from Cigna. Stay tuned.

UPDATE: Cigna has filed a notice to appeal on June 23, 2016. It came with a healthy $19m appeal bond.

![Law in the Digital Age: Exploring the Legal Intricacies of Artificial Intelligence [e323]](https://www.pashalaw.com/wp-content/uploads/2023/11/WhatsApp-Image-2023-11-21-at-13.24.49_4a326c9e-300x212.jpg)

![Unraveling the Workforce: Navigating the Aftermath of Mass Layoffs [e322]](https://www.pashalaw.com/wp-content/uploads/2023/07/Untitled-design-23-300x212.png)

![Return to the Office vs. Remote: What Can Employers Legally Enforce? [e321]](https://www.pashalaw.com/wp-content/uploads/2023/01/Pasha_LSSB_321_banner-300x212.jpg)

![Explaining the Hans Niemann Chess Lawsuit v. Magnus Carlsen [e320]](https://www.pashalaw.com/wp-content/uploads/2022/10/LAWYER-EXPLAINS-7-300x169.png)

![California v. Texas: Which is Better for Business? [313]](https://www.pashalaw.com/wp-content/uploads/2021/07/Pasha_LSSB_CaliforniaVSTexas-300x212.jpg)

![Buyers vs. Sellers: Negotiating Mergers & Acquisitions [e319]](https://www.pashalaw.com/wp-content/uploads/2022/06/Pasha_LSSB_BuyersVsSellers_banner-300x212.jpg)

![Employers vs. Employees: When Are Employment Restrictions Fair? [e318]](https://www.pashalaw.com/wp-content/uploads/2022/05/Pasha_LSSB_EmployeesVsEmployers_banner-1-300x212.jpg)

![Vaccine Mandates Supreme Court Rulings [E317]](https://www.pashalaw.com/wp-content/uploads/2022/02/WhatsApp-Image-2022-02-11-at-4.10.32-PM-300x212.jpeg)

![Business of Healthcare [e316]](https://www.pashalaw.com/wp-content/uploads/2021/11/Pasha_LSSB_BusinessofHealthcare_banner-300x212.jpg)

![Social Media and the Law [e315]](https://www.pashalaw.com/wp-content/uploads/2021/10/WhatsApp-Image-2021-10-06-at-1.43.08-PM-300x212.jpeg)

![Defining NDA Boundaries: When does it go too far? [e314]](https://www.pashalaw.com/wp-content/uploads/2021/09/Pasha_LSSB_NDA_WordPress-2-300x212.jpg)

![More Than a Mistake: Business Blunders to Avoid [312] Top Five Business Blunders](https://www.pashalaw.com/wp-content/uploads/2021/06/Pasha_LSSB_Blunders_WP-1-300x212.jpg)

![Is There a Right Way to Fire an Employee? We Ask the Experts [311]](https://www.pashalaw.com/wp-content/uploads/2021/02/Pasha_LSSB_FireAnEmployee_Website-300x200.jpg)

![The New Frontier: Navigating Business Law During a Pandemic [310]](https://www.pashalaw.com/wp-content/uploads/2020/12/Pasha_LSSB_Epidsode308_Covid_Web-1-300x200.jpg)

![Wrap Up | Behind the Buy [8/8] [309]](https://www.pashalaw.com/wp-content/uploads/2020/11/Pasha_BehindTheBuy_Episode8-300x200.jpg)

![Is it all over? | Behind the Buy [7/8] [308]](https://www.pashalaw.com/wp-content/uploads/2020/09/iStock-1153248856-overlay-scaled-300x200.jpg)

![Fight for Your [Trademark] Rights | Behind the Buy [6/8] [307]](https://www.pashalaw.com/wp-content/uploads/2020/07/Fight-for-your-trademark-right-300x200.jpg)

![They Let It Slip | Behind the Buy [5/8] [306]](https://www.pashalaw.com/wp-content/uploads/2020/06/Behind-the-buy-they-let-it-slip-300x200.jpg)

![Mo’ Investigation Mo’ Problems | Behind the Buy [4/8] [305]](https://www.pashalaw.com/wp-content/uploads/2020/05/interrobang-1-scaled-300x200.jpg)

![Broker or Joker | Behind the Buy [3/8] [304] Behind the buy - Broker or Joker](https://www.pashalaw.com/wp-content/uploads/2020/04/Joker-or-Broker-1-300x185.jpg)

![Intentions Are Nothing Without a Signature | Behind the Buy [2/8] [303]](https://www.pashalaw.com/wp-content/uploads/2020/04/intentions-are-nothing-without-a-signature-300x185.jpg)

![From First Steps to Final Signatures | Behind the Buy [1/8] [302]](https://www.pashalaw.com/wp-content/uploads/2020/04/first-steps-to-final-signatures-300x185.jpg)

![The Dark-side of GrubHub’s (and others’) Relationship with Restaurants [e301]](https://www.pashalaw.com/wp-content/uploads/2015/04/When-Competition-Goes-Too-Far-Ice-Cream-Truck-Edition-300x201.jpg)

![Ultimate Legal Breakdown of Internet Law & the Subscription Business Model [e300]](https://www.pashalaw.com/wp-content/uploads/2019/05/Ultimate-Legal-Breakdown-of-Internet-Law-the-Subscription-Business-Model-300x196.jpg)

![Why the Business Buying Process is Like a Wedding?: A Legal Guide [e299]](https://www.pashalaw.com/wp-content/uploads/2019/03/futura-300x169.jpg)

![Will Crowdfunding and General Solicitation Change How Companies Raise Capital? [e298]](https://www.pashalaw.com/wp-content/uploads/2018/11/Will-Crowdfunding-and-General-Solicitation-Change-How-Companies-Raise-Capital-300x159.jpg)

![Pirates, Pilots, and Passwords: Flight Sim Labs Navigates Legal Issues (w/ Marc Hoag as Guest) [e297]](https://www.pashalaw.com/wp-content/uploads/2018/07/flight-sim-labs-300x159.jpg)

![Facebook, Zuckerberg, and the Data Privacy Dilemma [e296] User data, data breach photo by Pete Souza)](https://www.pashalaw.com/wp-content/uploads/2018/04/data-300x159.jpg)

![What To Do When Your Business Is Raided By ICE [e295] I.C.E Raids business](https://www.pashalaw.com/wp-content/uploads/2018/02/ice-cover-300x159.jpg)

![General Contractors & Subcontractors in California – What you need to know [e294]](https://www.pashalaw.com/wp-content/uploads/2018/01/iStock-666960952-300x200.jpg)

![Mattress Giants v. Sleepoplis: The War On Getting You To Bed [e293]](https://www.pashalaw.com/wp-content/uploads/2017/12/sleepopolis-300x159.jpg)

![The Harassment Watershed [e292]](https://www.pashalaw.com/wp-content/uploads/2017/12/me-2-300x219.jpg)

![Investing and Immigrating to the United States: The EB-5 Green Card [e291]](https://www.pashalaw.com/wp-content/uploads/2012/12/eb-5-investment-visa-program-300x159.jpg)

![Responding to a Government Requests (Inquiries, Warrants, etc.) [e290] How to respond to government requests, inquiries, warrants and investigation](https://www.pashalaw.com/wp-content/uploads/2017/10/iStock_57303576_LARGE-300x200.jpg)

![Ultimate Legal Breakdown: Employee Dress Codes [e289]](https://www.pashalaw.com/wp-content/uploads/2017/08/Ultimate-Legal-Breakdown-Template-1-300x159.jpg)

![Ultimate Legal Breakdown: Negative Online Reviews [e288]](https://www.pashalaw.com/wp-content/uploads/2017/06/Ultimate-Legal-Breakdown-Online-Reviews-1-300x159.jpg)

![Ultimate Legal Breakdown: Social Media Marketing [e287]](https://www.pashalaw.com/wp-content/uploads/2017/06/ultimate-legal-breakdown-social-media-marketing-blur-300x159.jpg)

![Ultimate Legal Breakdown: Subscription Box Businesses [e286]](https://www.pashalaw.com/wp-content/uploads/2017/03/ultimate-legal-breakdown-subscription-box-services-pasha-law-2-300x159.jpg)

![Can Companies Protect Against Foreseeable Misuse of Apps [e285]](https://www.pashalaw.com/wp-content/uploads/2017/01/iStock-505291242-300x176.jpg)

![When Using Celebrity Deaths for Brand Promotion Crosses the Line [e284]](https://www.pashalaw.com/wp-content/uploads/2017/01/celbrity-300x159.png)

![Are Employers Liable When Employees Are Accused of Racism? [e283] Racist Employee](https://www.pashalaw.com/wp-content/uploads/2016/12/Are-employers-liable-when-an-employees-are-accused-of-racism-300x159.jpg)

![How Businesses Should Handle Unpaid Bills from Clients [e282] What to do when a client won't pay.](https://www.pashalaw.com/wp-content/uploads/2016/12/How-Businesses-Should-Handle-Unpaid-Bills-to-Clients-300x159.png)

![Can Employers Implement English Only Policies Without Discriminating? [e281]](https://www.pashalaw.com/wp-content/uploads/2016/11/Can-Employers-Impliment-English-Only-Policies-Without-Discriminating-300x159.jpg)

![Why You May No Longer See Actors’ Ages on Their IMDB Page [e280]](https://www.pashalaw.com/wp-content/uploads/2016/10/IMDB-AGE2-300x159.jpg)

![Airbnb’s Discrimination Problem and How Businesses Can Relate [e279]](https://www.pashalaw.com/wp-content/uploads/2016/09/airbnb-300x159.jpg)

![What To Do When Your Amazon Account Gets Suspended [e278]](https://www.pashalaw.com/wp-content/uploads/2016/09/What-To-Do-When-Your-Amazon-Account-Gets-Suspended-1-300x200.jpg)

![How Independent Artists Reacted to Fashion Mogul Zara’s Alleged Infringement [e277]](https://www.pashalaw.com/wp-content/uploads/2016/08/How-Independent-Artists-Reacted-to-Fashion-Mogul-Zaras-Alleged-Infringement--300x159.jpg)

![Can Brave’s Ad Replacing Software Defeat Newspapers and Copyright Law? [e276]](https://www.pashalaw.com/wp-content/uploads/2016/08/Can-Braves-Ad-Replacing-Software-Defeat-Newspapers-and-Copyright-Law-300x159.jpg)

![Why The Roger Ailes Sexual Harassment Lawsuit Is Far From Normal [e275]](https://www.pashalaw.com/wp-content/uploads/2016/07/WHY-THE-ROGER-AILES-SEXUAL-HARASSMENT-LAWSUIT-IS-FAR-FROM-NORMAL-300x159.jpeg)

![How Starbucks Turned Coveted Employer to Employee Complaints [e274]](https://www.pashalaw.com/wp-content/uploads/2016/07/iStock_54169990_LARGE-300x210.jpg)